If you are looking for real estate strategies that are less than or not quite creative than read on below.

There are real estate assets and there are strategies.

Choose your real estate assets according to what you are buying and selling.

It’s like a trading game.

If you have a $15M apartment building in New York then you can get matched with a cash buyer.

That’s when the money is made.. and everybody knows it!

Buy And Sell

You might have a few billion dollar portfolio; That might all be what you need… but if you are playing the game then you need to buy and sell.

The strategies that follow different buying and selling are found here: the Fistfuls of Cash: 20 Creative Real Estate Investing Strategies.

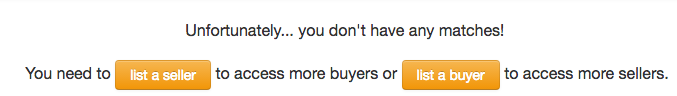

The different assets are found here: listing a cash buyer or a motivated seller.

Mostly detached SFRs or houses… that you can get in the middle of.

Or commercial and industrial property that range from Office Buildings to Luxury Hotels, Mines, and Oilfields.

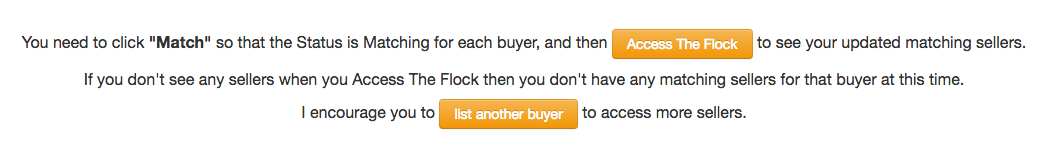

Once you Access The Flock…

Other People’s Money — OPM

One of the best strategies is using Other People’s Money!

You can joint venture. Find a deal and get access to a cash buyer!

Buy & Improve

Make improvements to property. Command the most exact and optimum amount of rent that you can get for the property for the market — location.

Don’t leverage, use cash buyers. Use the property as a bank.

The less the mortgage the more the rent. That cash flows.

This keeps you protected in case of market turmoil — when prices drop and you still have equity!

Access The Flock!

Cash

Remember, it’s about the cash.

Keep it in a bank.