Fistfuls of Cash: 20 Creative Real Estate Investing Strategies

Make money closing real estate deals by using these 20 creative real estate strategies.

1. No Money Down

What is no money down real estate investing?

No money real estate is a creative real estate strategy where the buyer borrows 100% of the purchase price. When the buyer doesn’t make a downpayment they do not have to use any of the cash from their savings to purchase property. If the property that you purchase cash flows then you do not have to worry about money because you just acquired an asset that pays you without putting any of your own money into the asset.

Your payments will be larger so make sure it cash flows.

Your mortgage payments might be larger because when you borrow more money so when you analyze your deal make sure it cash flows. Do a simple cash flow analysis where you enter in at the top how much rent you will collect from the property followed by all of the expenses you will need to pay to maintain the property (like insurance, taxes, and heating). Subtract your expenses from your rent and you get the cash flow.

What are the risks to no money down real estate?

Borrowing funds is riskier than putting your own money down on a property because the value of the property can decline — like a real estate bubble bursting — and you can be left with a loan that is bigger than the value of your property.

I can tell you that mortgages with higher loan-to-value (LTV) are more susceptible to default; If the size of the mortgage is large compared to the value of the property, there is a greater risk of default than if the LTV is lower. If the the vacancy rate goes up so that the property can not cover the mortgage payments you might default.

Many real estate gurus recommend that it is OK to own a property with no money down as long as it cash flows because the income from the property can cover your expenses until the value of the property comes back up — in the case of a real estate market crash.

If it doesn’t cash flow it might not be the best sustaining deal. It could blow up in your face because unexpected repair costs and loss of tenants!

Check your government backed or insured lending programs in your area to see what is legal.

Sandwich Lease Option

Sandwich lease option builds the number of doors that you have that cash flow with no money down. Sandwhich lease option is giving a tenant the option to buy a motivated seller’s property.

If you want to acquire two properties at the same time you can buy a new property and have the motivated seller as the tenant.

What are the risks to the sandwhich lease option strategy?

You need marketing costs to find a motivated seller and a tenant buyer. It is difficult to repair homeowners’ budgets.

More reading on no money down real estate investing strategies:

2. Owner Financing:

Owner financing is a group of creative real estate strategies where you convince the seller to finance the mortgage.

The four types of owner financing are:

- Assumable Mortgage

- Subject-To Financing

- Vendor Take Back (VTB)

- Wrap Around Mortgage

- Agreement For Sale

Assumable Mortgage

What is an assumable mortgage?

An assumable mortgage is a mortgage with a clause that says that you can takeover the mortgage and get a better interest rate than markets currently have.

Ask your seller if they have an assumable mortgage to find out whether you can get a great deal.

Subect-To Financing

What is subject-to financing?

Subject-to financing is creating a new agreement with the seller that has identical terms as their existing mortgage. You take over deed (in the US) or title (in Canada) and the motivated seller’s mortgage stays on title. Your benefits include a faster sale because you do not have to qualify for a new mortgage with a bank and you are purchasing property at a discount because the seller is in foreclosure.

Your motivated seller could stay in the home as a tenant in a rent-to-own agreement with you while they rebuild their credit and buy the property back from you in a few years or — if that doesn’t work — you could get tenants that pay the motivated seller’s mortgage if the seller is not financially capable of staying in the house.

What is the due-on-sale clause?

According to creonline.com:

The “due on sale” clause states that the lender has the right to call the entire note due if any of the terms of the initial agreement are not met, such as payments being paid or transfer of the deed without paying off the original loan.

You might need to negotiate with the seller’s bank.

What are the risks of subject-to financing?

Subject-to financing could be seen as predatory because you are targeting foreclosures. Lawyers might stop this type of deal from going through even though it could be legal.

Vendor Financing (VTB)

What is a vendor take back mortgage?

- A vendor take back mortgage is when you buy a property with less of your own money by convincing the seller to mortgage as much of the property to you.

According to whichmortgage.ca: “with cooler housing conditions, lower prices than some sellers want to accept, and terribly low rates on GIC’s…” they’re …“finding more sellers willing to entertain the option of financing some of the property to increase their return, speed up the sale and get a good price for their property.”

What are the risks to VTB?

You could pay a higher interest rate because the seller could ask for a return higher than what you would get at a bank. Higher interest rates will reduce your cash flow and make owning your investment property more stressful.

Wrap Around Mortgage

A wrap around mortgage is also known as “wrap”.

What is a “Wrap”?

A wrap is when a buyer convinces the seller to finance the sale of the property using a second mortgage. You, as a buyer, will pay the wrap around mortgage and the seller will use those payments to pay their mortgage.

Here is an example of using a wrap from creonline.com:

$120,000 purchase price

$5,000 cash down payment

$115,000 to be held by seller as a wraparound mortgage

You explain to the seller that you will make them monthly installment payments on a $115,000 promissory note secured by a purchase money wraparound mortgage that will encircle their existing $100,000 bank first lien mortgage.

What are the risks of a wrap around mortgage?

The size of the second mortgage could be too large; Different jurisdictions have different laws on the size of the mortgages that can be taken out on a property.

You should speak to a lawyer about drafting the right type of mortgage.

Agreement For Sale

Agreement for sale is adding documents to a purchase contract so that you can get control of a property with as little of your own money as possible.

The essential first part of an AFS is that even though the buyer takes full possession of the property and is responsible for taxes, insurance, and maintenance of the property, the title remains in the seller’s name. Sellers love that title remains in their name when they are providing the financing.

Agreement for sale requires partnering with a lawyer.

3. Contingency Clauses in Contracts

Contingency clauses are clauses that you can put in your real estate contracts when purchasing property to help you escape from the deal when it falls through. Contingency clauses are also known as escape clauses.

Why would you use contingency clauses?

Contingency clauses reduce your risk when making money in real estate.

Examples of contingency clauses in your contracts:

Subject-To Inspection

Subject-to inspection clauses allow you to inspect a property before the deal closes.

If you do not have the subject-to inspection clause in your contracts you might have to do unexpected and expensive repairs. You do not want to be stuck in a deal where you can not afford to make repairs. By getting a home inspection before closing the deal you can avoid losses.

It is good to get an inspection because you do not want to be liable to your tenants for hidden beams that could break threatening their lives. It surprises me that some real estate professionals do their own home inspections.

You should use the subject-to inspection clause in your contracts so that you can save money by getting inspections done before closing a deal.

When you buy a property sight-unseen it might not be possible to have a subject-to inspection clause.

Subject-To Fixtures, Appliances, and Furniture

You need to be specific about what fixtures, furniture, and appliances you want to keep when you close a deal.

You do not want to buy fixtures, furniture, and appliances. It is better if the property already comes with fixtures, furniture, and appliances.

Fixtures are fixed to the property. They are difficult to replace. It is good to get an inspection to make sure that important fixtures are attached to the property before you close your deal.

The more furniture, fixtures, and appliances on the property the happier your tenants will be and you will make more money. Furniture, fixtures, and appliances are assets that need to be accounted for so that you increase your cash flow.

Subject-To Appraisal

There are pictures in the appraisal so you can see if the property is in good condition. The appraisal shows comparable properties.

Buyers and sellers should know how much the property is worth.

Motivated sellers will sometimes keep the price high and negotiate other favorable terms like positive cash flow.

Subject-To Financing

Not everyone has a cash buyer.

It is good to get your financing approved. Documents need to be submitted to the banks. Financing can take 30 days. Some mortgage brokers know alternative lending sources.

The subject-to financing clause will allow you to get cash so that you can make money on real estate.

4. Joint Venture

Joint venturing is partnering with a buyer and finding them property. You can negotiate 50% of the cash flow from the property with the buyer for finding the deal. You can also get a percentage of the transaction. I have seen lots of fee agreements with lists of real estate professionals’ commissions.

You can also setup a corporation and sell shares. The main activity of the corporation is to buy real estate.

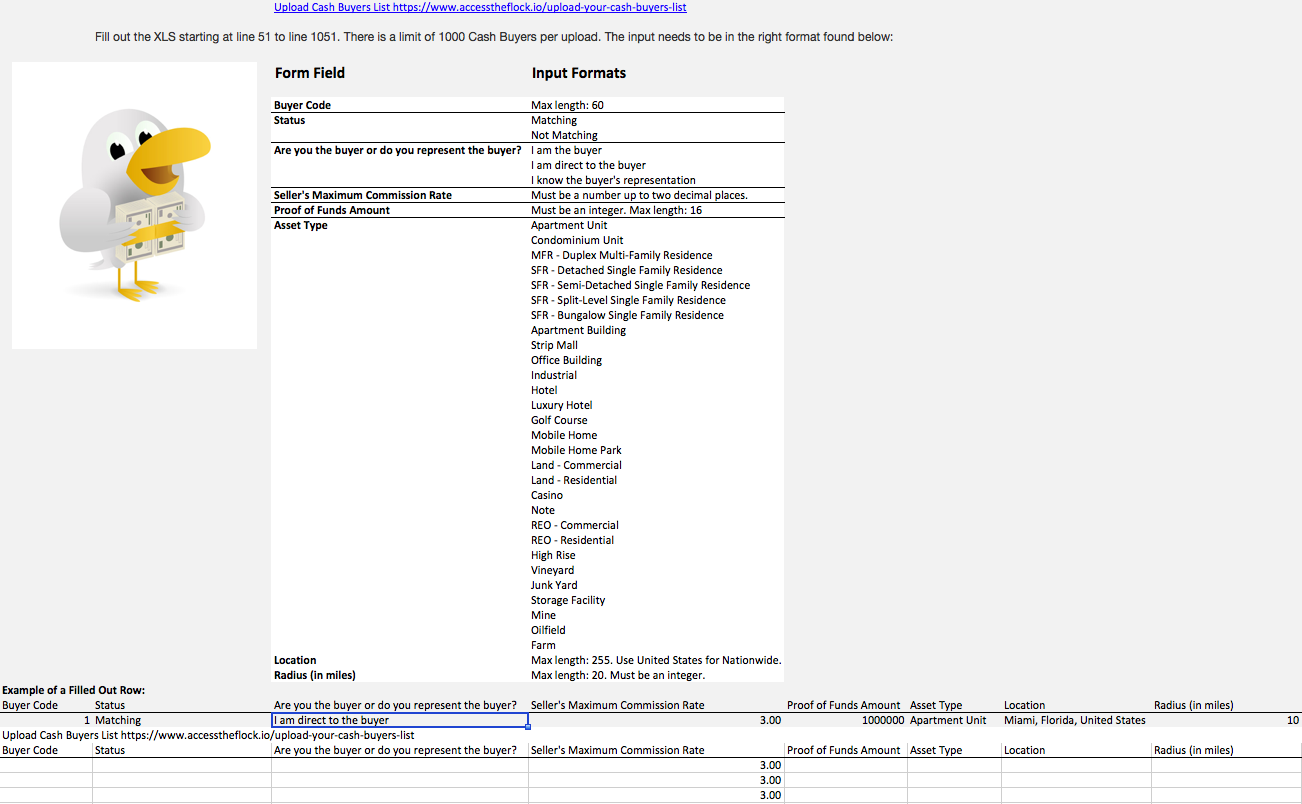

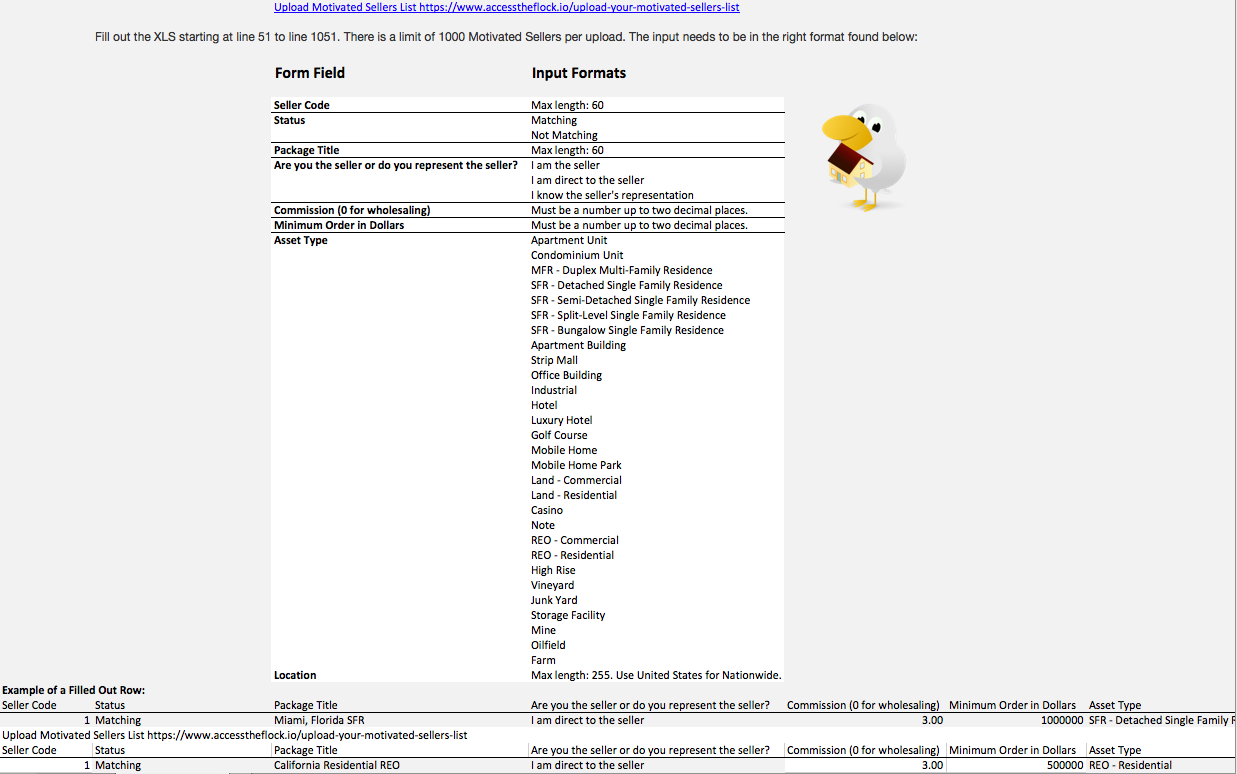

The key to making money joint venturing is to have direct access to a buyer and a seller.

There are real estate professionals that bulldoze through Daisy Chains to get access to cash buyers and motivated sellers. Having a property under contract and circulating property information attracts buyers. Attracting buyers helps you make money by closing your current deals and by building your buyers list for future deals.

If you do not have your buyers and sellers under contract then your deal might fall through because of circumvention. Circumvention is a problem where buyers and sellers try to cut you out of the deal because you do not have a contract and because they are not reputable.

Direct mail creates direct access to motivated sellers. Sellers might expect an earnest money deposit when you sign the purchase contract. Buyers look for discount deals or deals that cash flow.

You can get access to buyers and sellers online, at local private clubs, at your local real estate investor’s association, by posting a ads in the newspaper.

5. Hard Money

Hard money is a loan with a high interest rate.

Hard money is leverage that increases your net worth. Hard money allows you to own more property.

Hard money can be used in the short term. You can use hard money to make repairs to your property or to finance the purchase of a great deal. Refinance at a lower rate when you can because hard money is expensive.

If you can not afford a hard money loan you might have to sell your property. Run a cash flow analysis to figure out what you can afford.

Mortgage brokers and private lenders can do hard money loans.

You need paperwork to qualify.

6. Buy and Hold Rental Property With Cash Flow

Cash flow is king.

Many real estate professionals accumulate cash flowing properties.

Sometimes market conditions make it difficult for property to cash flow. Property can break-even. Analyse the cash flow before buying.

Renovations are a great way to boost cash flow.

If cash flow is break-even you can still get capital gains.

7. Rehabbing and Hold

Rehabbing property is increasing the value of the property by making repairs. You can get capital gains by holding the property.

Figure out how much money you can make rehabbing and holding a property by using this calculator.

8. Flipping

Flipping is profiting by renovating and selling property at a higher price than what you paid for it.

Cost of repairs tend to be higher than what is budgeted.

Buy property at a discount. Make valuable improvements to property.

9. Wholesaling

Wholesaling is flipping a contract between a buyer and seller.

You need marketing expertise to be a wholesaler. The cost of acquiring a contract from a seller can be too high if you do not have a buyer to sell that contract to quickly.

Assignment allows buyers to assume your contract. Buyers want to assume contracts where they profit. You need to source real estate at a discount so that you can sell purchase contracts at a profit to buyers. You get an assignment fee at closing with a lawyer. Add “and/or assignee” in your contract.

Direct mail is used by coaches to find motivated sellers.

According to Investopedia:

A typical wholesaling scenario looks like this: The wholesaler has a house under contract for $90,000 that he estimates needs $20,000 in repairs but will sell for $150,000 once the repairs are made. Using his network of investors, he finds an eager buyer at $100,000. He assigns the contract to his investor, who then has a profitable fixer-upper project, and the wholesaler made a $10,000 profit without ever owning the home.

A lot of wholesalers believe that they can wholesale without no money. There is no carrying cost. There is an earnest money deposit with the seller. There is a marketing cost.

Some real estate professionals say that wholesaling is illegal. Consult a lawyer.

Here is further reading on how to wholesale a deal step by step.

10. Rent-to-Own (Lease Option)

Rent-to-own is helping a homeowner stay in their home by buying the homeowner’s property and allowing them to rent the property with the option to buy the property back at a later date.

Rent-to-own’s are extremely profitable. You get capital gains because you negotiate an appreciated buy back price in the future and you get cash flow above market rents because of the downpayment to buy the property back.

What are the risks of rent-to-own?

It is difficult to repair homeowners’ budgets. The appreciated purchase price that you use in your contract can be seen as predatory by lawyers.

11. Perfect Tenant

Perfect tenant is a strategy where you find a perfect tenant for a joint venture partner.

Joint venture partners will be pleased to have a qualified tenant when buying a real estate investment.

You can find motivated sellers via direct mail. You can find tenants online and in the newspaper. Cash buyers can be found online.

It is good to keep your marketing on all of the time to create cash flow from joint venture deals.

12. Bank Foreclosures/REO

You can purchase lists of foreclosures online.

You can build relationships with Asset Managers on LinkedIn. Mention that you can help with REO.

13. HUD Foreclosures

You can get cash flow from foreclosures.

What is HUD?

HUD is the Department of Housing and Urban Development (US Government).

HUD sells foreclosures.

Registered real estate brokers and other organizations can bid on HUD listings.

Investors can purchase HUD listings after they have been offered to owner occupants.

You can buy a HUD foreclosure with cash or a FHA loan.

“HUD strongly urges every potential homebuyer to get an inspection from a licensed professional home inspector prior to submitting an offer to purchase.”

14. Short Sales

What is a short sale?

A short sale happens when the lenders agree to sell property for less than the amount that they are owed.

Buying short sales helps motivated sellers avoid foreclosure and legal fees.

You can make cash flow from short sales. You need to do a cash flow analysis before buying short sales.

What are the risks of buying short sales?

You need property inspections and insurance information. Short sales can take time because lenders don’t want to sell.

15. Probate Properties

A probate property is a property for sale after a death.

The benefit of buying probate properties is that they can sell for below market value.

You can find probate properties through courts in some jurisdictions. Governments change how they distribute information; It is good to diversify your source of information so that you do not go out of business.

16. Tax Liens/Deeds

A tax lien is created by the government when taxes on a property aren’t paid. Tax liens can be sold to investors.

The difference between tax liens and tax deeds is that when you buy a tax deed you own the property free and clear.

What are the risks to tax liens?

Property owners might not be able to pay back the taxes.

What are the advantages to tax liens?

You could acquire property.

17. Land

Investing in land is risky. Investopedia recommends some ETFs (exchange traded funds) that you can invest in.

If you are a REIT, the Flock has land that you can access.

18. Investing in a REIT

A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate.

From an investment standpoint, many options, such as the Vanguard REIT ETF (VNQ), provide diversified exposure to industrial, office, retail, health care, public storage and residential property developments. For most small investors, REIT ETFs are an ideal choice because they do not require direct management, they are broadly diversified by property type, they are geographically diversified, they can be purchased or sold on a real-time basis and they are very inexpensive.

19. Lend on Second Mortgages

Lending on second mortgages returns a higher interest rate if the deal is good.

You can acquire property that you lend on if the borrower defaults.

20. Match

Matchmaking is the ideal way to make money in real estate.